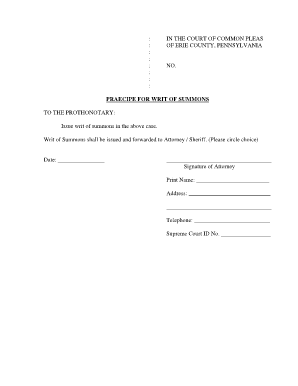

Campbell Mortgage Gift Letter free printable template

Show details

00 or imprisoned not more than two years or both. GIFT LETTER INSTRUCTIONS During the course of your mortgage application interview the fact that a part of your closing costs and down payment will be funded by a gift was discussed. In order to assist you in completing the gift letterform you have been given the instructions listed below have been prepared. It is important that you understand the reason for the requirements. GIFT LETTER DONOR SECTION I/We am/are Name of Donor/s Please legibly...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign gift qualified amounts form

Edit your mortgage gift letter template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gift letter for mortgage template form via URL. You can also download, print, or export forms to your preferred cloud storage service.

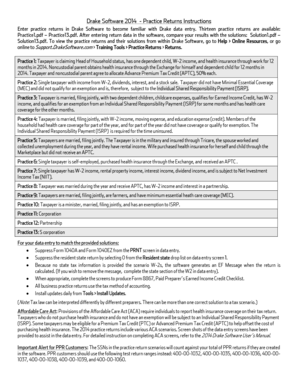

Editing sample gift letter for mortgage online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit gift letter template for mortgage form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gift tax funds form

How to fill out Campbell Mortgage Gift Letter

01

Begin with the date at the top of the letter.

02

Include the names and contact information of both the donor and the recipient.

03

State the relationship between the donor and the recipient.

04

Specify the amount of the gift being provided.

05

Clearly indicate that the gift does not need to be repaid.

06

Affirm that the funds are a genuine gift and not a loan.

07

Provide a statement confirming the gift is being made without any expectation of future payment.

08

Sign the letter at the bottom, including the donor's signature.

Who needs Campbell Mortgage Gift Letter?

01

Individuals applying for a mortgage using gifted funds for down payment.

02

Donors providing financial assistance to homebuyers.

Fill

gift letter mortgage template

: Try Risk Free

People Also Ask about fannie mae gift letter pdf

How does the IRS know if I give a gift?

Filing Form 709: First, the IRS primarily finds out about gifts if you report them using Form 709. As a requirement, gifts exceeding $15,000 must be reported on this form.

Is there a penalty for filing a gift tax return late with no tax due?

If those situations where no income tax is due (such as when sufficient income tax withholdings or estimated income tax payments were made), there are no FTF or FTP penalties assessed. We briefly mentioned the 2021 annual gift tax exclusion of $15,000.

What is a 709 gift tax form?

Form 709 is used to report transfers subject to the Federal gift and certain generation-skipping transfer (GST) taxes, and to figure the tax, if any, due on those transfers. Form 709 InstructionsPDF. This item contains helpful information to be used by the taxpayer in preparation of Form 709, U.S. Gift Tax Return.

What is the difference between form 706 and form 709?

What's the difference between Form 706 and Form 709? Form 706 is filed by the executor of an estate on behalf of a deceased person to calculate estate tax owed, while the latter is filed by you to report gifts exceeding the annual exclusion.

What happens if I don't file a gift tax return?

If you make a taxable gift to someone else, a gift tax return needs to be filed. If you fail to do this, penalties may apply. If you don't file the gift tax return as you should, you could be responsible for the amount of gift tax due as well as 5% of the amount of that gift for every month that the return is past due.

Do I really need to file a gift tax return?

Who Must File. In general. If you are a citizen or resident of the United States, you must file a gift tax return (whether or not any tax is ultimately due) in the following situations. If you gave gifts to someone in 2022 totaling more than $16,000 (other than to your spouse), you probably must file Form 709.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my gift letter sample in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your gift letter and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I execute printable gift letter template online?

pdfFiller has made it easy to fill out and sign irs gift letter. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I complete gift letter for mortgage on an Android device?

Use the pdfFiller app for Android to finish your fannie mae gift letter template. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

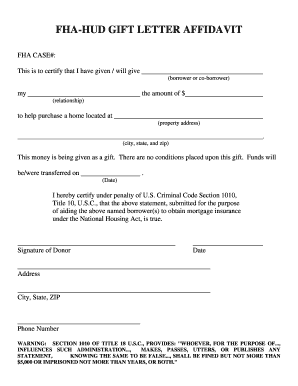

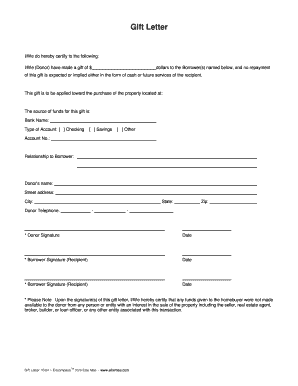

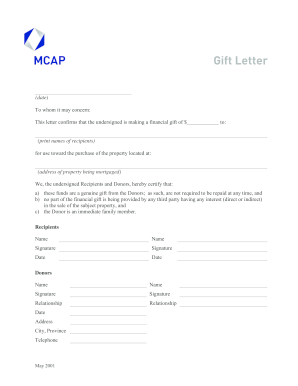

What is Campbell Mortgage Gift Letter?

The Campbell Mortgage Gift Letter is a document used in real estate transactions that allows individuals to provide financial gifts to home buyers for the purpose of assisting with the down payment or closing costs. It confirms that the funds do not need to be repaid.

Who is required to file Campbell Mortgage Gift Letter?

Typically, the home buyer receiving the gift must file the Campbell Mortgage Gift Letter, especially when the gifted funds are being used for a mortgage application, to disclose the source of the down payment.

How to fill out Campbell Mortgage Gift Letter?

To fill out the Campbell Mortgage Gift Letter, the donor should provide their name, address, relationship to the recipient, gift amount, and a statement confirming that the funds are a gift and do not need to be repaid.

What is the purpose of Campbell Mortgage Gift Letter?

The purpose of the Campbell Mortgage Gift Letter is to confirm that the funds provided as a gift are indeed a gift and not a loan. This is important for lenders to ensure that the borrower meets the necessary financial requirements for mortgage approval.

What information must be reported on Campbell Mortgage Gift Letter?

The Campbell Mortgage Gift Letter must include information such as the donor's name and address, the recipient's name, the amount of the gift, the relationship between the donor and recipient, and a statement indicating that the gift does not need to be repaid.

Fill out your Campbell Mortgage Gift Letter online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gift Letter For Mortgage Sample is not the form you're looking for?Search for another form here.

Keywords relevant to mortgage gift letter sample

Related to gift letter for tax purposes

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.